https://www.brickworkratings.com/Admin/PressRelease/Agarwal-Mittal-Concast-19June2020.pdf

Category Archives: Uncategorized

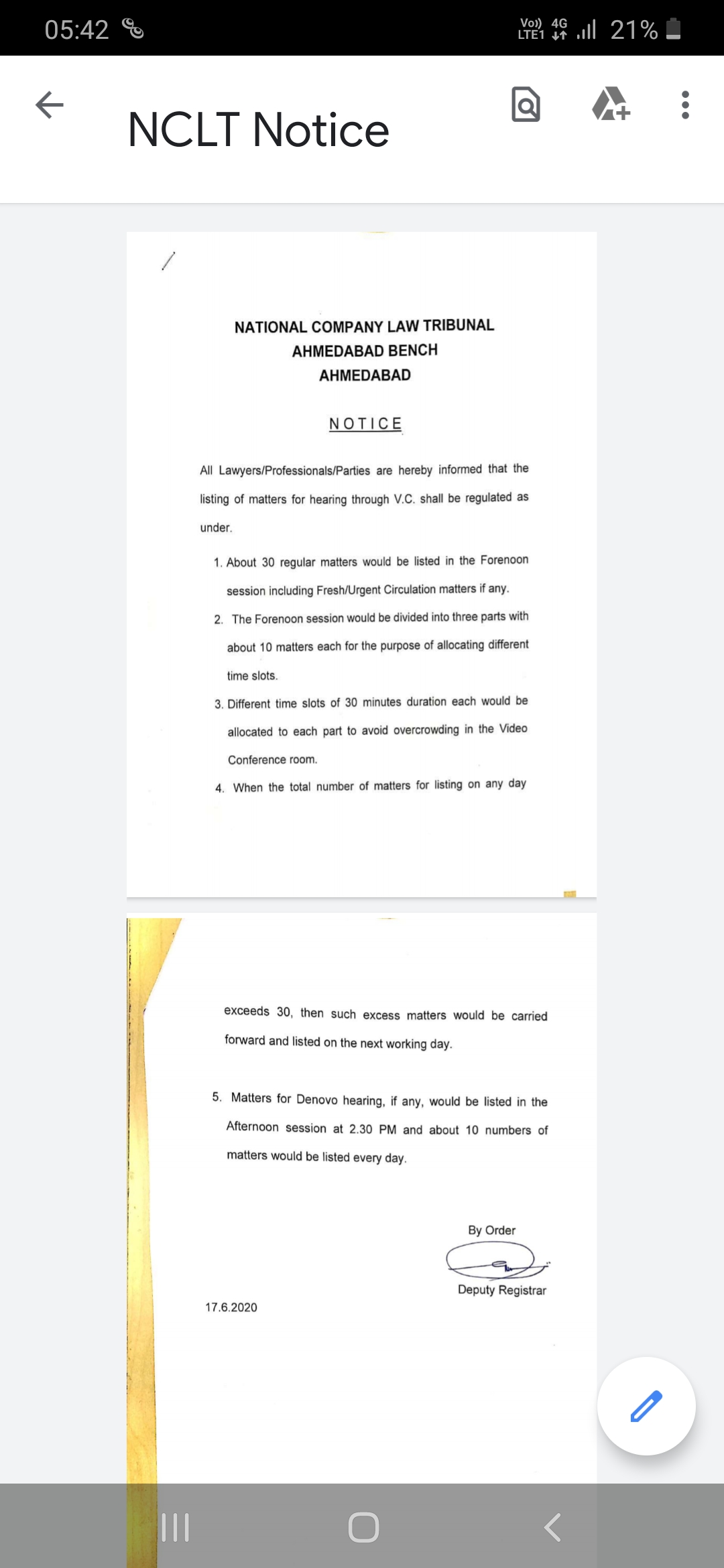

Nclt ahmedabad notice dated 17.06.2020

Valuation Report Income tax Capital gains: Whether AO has power to refer the matter to DVO and deny the valuation report as on 1-4-1981 of a registered valuer?

held that AO had no power to refer the matter to DVO in order to reduce the FMV adopted by the assessee. Thus, assessee had rightly computed capital gain based on the valuation report as on 1-4-1981 of a registered valuer.

IN THE INCOME TAX APPELLATE TRIBUNAL “D”

BENCH, AHMEDABAD

BEFORE SHRI MANISH BORAD, AM AND SHRI AMARJIT SINGH, JM

आयकर अपील सं / I.T.A. No.1061/Ahd/2017

(निर्धारण वर्ा / Assessment Year: 2012-13)

Shri Dinesh Khodidas Patel बिधम/ ITO, Ward-1(3)(3)

HUF. Vs. 1st Floor, Pratyakshkar

15/A Gokul Nagar Society,

Bhavan, Ambawadi,

Usmanpura Ahmedabad-

380013. Ahmedabad-380015.

स्थायी लेखा सं ./जीआइआर सं ./PAN/GIR No. : AAGHP2757M

(अपीलाथी /Appellant) .. (प्रत्यथी / Respondent)

Assessee by: Shri M. S. Chhajed (AR)

Revenue by: Shri Vinod Tanwani (Sr. DR)

सुनवाई की तारीख / Date of Hearing: 18/09/2019

घोषणा की तारीख /Date of Pronouncement: 19/09/2019

आदे श / O R D E R

PER AMARJIT SINGH, JM:

The assessee has filed the present appeal against the order dated 29.03.2017 passed by the Commissioner of Income Tax (Appeals)-10, Ahmedabad [hereinafter referred to as the “CIT(A)”] relevant to the A.Y.2012-13.

2. The assessee has raised the following grounds:-

“1 The order passed by the CIT(A) is against law, equity and justice.

2. The order passed by the Ld. CIT(A) is against law, equity and bad in the eyes of law.

ITA. No.1061/Ahd/17 A.Y. 2012-13

3. The Ld. AO has erred in law and on facts in issuing noitce u/s 251(1)(a) of the Act.

4. The Ld. CIT(A) has erred in law and or facts in accepting the valuer of land as per report of DVO which pertains to area far away from the land sold by the appellant.

5. The Ld. CIT(A) has erred in law and on facts in considering the fair market value of land at Rs.2,45,000/- ignoring the value of land determined by the registered valuer of Rs.40,56,000/-.

6. The Ld. CIT(A) has erred in law and or facts upholding the order of the Ld. AO in not allowing the dedcution u/s 54F amounting to Rs.96,31,350/- in regards to investment made in land.

7. The appellant craves liberty to add, amend alter or modify all or any grounds of appeal befoe final disposal.”

3. The brief facts of the case are that the assessee filed its return of income on 30.08.2012 declaring total income to the tune of Rs.2,86,22,160/- for the A.Y.2012-13. The return was processed u/s 143(1) of the I.T. Act, 1961. The case was selected for scrutiny. Notices u/s 143(2) & 142(1) of the Act were issued and served upon the assessee. On verification, it was found that the assessee sold a land situated at block no.349 Sim-Ambli, Mouje Gam Taluka Dascroi District- Ahmedabad along with others co-owners at a consideration of Rs.18,00,00,000/-. The sale- deed was got registered on 15.06.2011 in the office of Sub-registrar AHD-3 Memnagar. The assessee received a sum of Rs.5,90,00,000/- as his share in this transaction. The assessee also furnished the copy of sale deed. The assessee has also submitted the valuation report as on 01.04.1981 by a registered valuer namely Er. Girishkumar H. Shah. He also furnished copy of sale deed of land situated at Heritage Homes of Rs.90,00,000/- in support of his claim u/s 54F of the Act. The AO was not satisfied with the report of valuation, therefore, called the DVO report who determined the cost of assets of Rs.81,800/- as on 01.04.1981 and accordingly assessed the ITA. No.1061/Ahd/17 A.Y. 2012-13 long term capital gain. The claim of the assessee u/s 54F of the Act was also denied being the purchased property was not the residential property and was not fully constructed and the total income of the assessee was assessed to the tune of Rs.4,49,33,200/-. Feeling aggrieved, the assessee filed an appeal before the CIT(A) who partly allowed the claim of the assessee but the assessee was not satisfied on the grounds raised above, therefore, the assessee has filed the present appeal before us.

4. We have heard the Ld. Representative of the parties and perused the record. At the very outset, the Ld. Representative of the assessee has argued that this issue has duly been covered in favour of the assessee by the decision of Hon’ble ITAT in the case of co-sharer of the same land, therefore, the claim of the assessee is liable to be allowed in the interest of justice. However, on the other hand, the Ld. Representative of the Department has refuted the said contention. The decision of the Hon’ble ITAT in the case of Shri Jayesh Khodidas Patel Vs. ITO in ITA No.1062/Ahd/2017 dated 24.06.2019 is on the file and the relevant finding has been given in para no. 7 which is reproduced as under.:-

“7. Considering the rival submissions and material on record, we noticed from the records submitted before us, the A.O has referred the value of the FMV of the land on 01.04.1981 to the DVO as per which DVO has valued the FMV as on 01.04.1981 which is materially less than the value adopted by the assessee which is based on registered valuer who valued FMV based on the valuation method submitted by him. We noticed that Ld. CIT(A) has accepted the contentions of the assessee that A.O has no power to refer the matter to the DVO as per the provisions existed at that point of time. However, he proceeded to enhance the assessment by observing certain defects / short comings in the valuation report and it is pertinent to note that the same report was placed before the A.O. However, we noticed that Ld. CIT(A) has acknowledged the fact that A.O has no power to refer the matter to DVO or reduce the FMV as value. When the power is not with the A.O ITA. No.1061/Ahd/17 A.Y. 2012-13 to reduce the FMV as examined by the assessee as the FMV as on 01.04.1981 and the same to the CIT(A) as well, since the enhancement proceedings are extended assessment proceedings.

8. Considering the fact that Ld. CIT(A) performed the extended assessment proceedings, even though he has co-terminus power to enhance the assessment of income, he cannot apply the same provision on which A.O has no power to refer the matter to DVO in order to reduce the FMV. Ld. CIT(A) Found discrepancies in Valuation Report enhance the assessed income. Therefore, in our opinion, relying on the decision of Hon’ble Jurisdictional High Court in the case of Hiaben Jayantilal Shah Vs. ITO (supra), A.O cannot refer the estimation of FMV to DVO in order to reduce the FMV value adopted by the assessee. In the given case, CIT(A) also do not have any right to redo the, similar action in another method. Accordingly, the enhancement made by the CIT(A) is deleted and grounds raised by the assessee are allowed.”

5. The above mentioned finding has been given by Hon’ble ITAT in the case of co-sharer of the land in which the assessee is also the co-sharer. The finding of the Hon’ble ITAT is also applicable to the present case, because, the matter of controversy is the same, therefore, by honoring the decision of the co-ordinate bench, we decide this issue in favour of the assessee against the revenue.

ISSUE NO.2

6. Under this issue the assessee has challenged the disallowance of deduction u/s 54F of the Act amounting to Rs.96,31,350/-. The AO declined the claim of the assessee on the basis of this fact that the construction was not completed within the period of 3 years. The other factual things are not in dispute. The assessee purchased a plot no. 42(old survey no.266-1 and 266-2, 273) of heritage home of Rs.96,31,350/- out of sale consideration received from the land. The appellant made the investment for the construction of a residential house to claim u/s 54F of the Act. The appellant failed to complete construction within the period of ITA. No.1061/Ahd/17 A.Y. 2012-13 3 years. However, the appellant invested a sum of Rs.1,96,31,350/- for residential house eligible for deduction u/s 54F of the Act. The AO nowhere disputed this fact that the assessee did not invest the amount for the construction for residential house. However, the fact which has been disputed by AO is that the assessee has failed to prove the completion of the construction within the period of 3 years, therefore, the assessee was not entitled for deduction u/s 54F of the Act. The relevant provision of section 54F of the Act is hereby reproduced as under:-

“54F. (1) Subject to the provisions of sub-section (4), where, in the case of an assessee being an individual or a Hindu undivided family], the capital gain arises from the transfer of any long-term capital asset, not being a residential house (hereafter in this section referred to as the original asset), and the assessee has, within a period of one year before or two years after the date on which the transfer took place purchased, or has within a period of three years after that date constructed, a residential house (hereafter in this section referred to as the new asset), the capital gain shall be dealt with in accordance with the following provisions of this section, that is to say,–

(a) if the cost of the new asset is not less than the net consideration in respect of the original asset, the whole of such capital gain shall not be charged under section 45 ;

(b) if the cost of the new asset is less than the net consideration in respect of the original asset, so much of the capital gain as bears to the whole of the capital gain the same proportion as the cost of the new asset bears to the net consideration, shall not be charged under section 45:

Provided that nothing contained in this sub-section shall apply where–

(a) the assessee,–

(/) owns more than one residential house, other than the new asset, on the date of transfer of the original asset; or

(ii) purchases any residential house, other than the new asset, within a period of one year after the date of transfer of the original asset; or ITA. No.1061/Ahd/17 A.Y. 2012-13

(iii) constructs any residential house, other than the new asset, within a period of three years after the date of transfer of the original asset; and

(b) the income from such residential house, other than the one residential house owned on the date of transfer of the original asset, is chargeable under the head “Income from house property”.] Explanation.–For the purposes of this section,– “net consideration”, in relation to the transfer of a capital asset, means the full value of the consideration received or accruing as a result of the transfer of the capital asset as reduced by any expenditure incurred wholly and exclusively in connection with such transfer. (2) Where the assessee purchases, within the period of two years after the date of the transfer of the original asset, or constructs, within the period of three years after such date, any residential house, the income from which is chargeable under the head “Income from house property”, other than the new asset, the amount of capital gain arising from the transfer of the original asset not charged under section 45on the basis of the cost of such new asset as provided in clause (a), or, as the case may be, clause (b), of sub-section (1), shall be deemed to be income chargeable under the head “Capital gains” relating to long-term capital assets of the previous year in which such residential house is purchased or constructed. (3) Where the new asset is transferred within a period of three years from the date of its purchase or, as the case may be, its construction, the amount of capital gain arising from the transfer of the original asset not charged under section on the basis of the cost of such new asset as provided in clause (a) or, as the case may be, clause (b), of sub- section (1) shall be deemed to be income chargeable under the head “Capital gains” relating to long term capital assets of the previous year in which such new assets is transferred.

[(4) The amount of the net consideration which is not appropriated by the assessee towards the purchase of the new asset made within one year before the date on which the transfer of the original asset took place, or which is not utilized by him for the purchase or construction of the new asset before the date of furnishing the return of income ITA. No.1061/Ahd/17 A.Y. 2012-13 under section 139. shall be deposited by him before furnishing such return [such deposit being made in any case not later than the due date applicable in the case of the assessee for furnishing the return of income under sub-section (1) of section 1391 in an account in any such bank or institution as may be specified in, and utilised in accordance with, any scheme which the Central Government may, by notification in the Official Gazette, frame in this behalf and such return shall be accompanied by proof of such deposit; and, for the purposes of sub- section (1), the amount, if any, already utilised by the assessee for the purchase or construction of the new asset together with the amount so deposited shall be deemed to be the cost of the new asset:

Provided that if the amount deposited under this sub- section is not utilised wholly or partly for the purchase or construction of the new asset within the period specified in subsection (1), then,–

(i) the amount by which–

(a) the amount of capital gain arising from the transfer of the original asset not charged under section 45 on the basis of the cost of the new asset as provided in clause

(a) or, as the case may be, clause (b) of sub-section (1), exceeds

(b) the amount that would not have been so charged had the amount actually utilised by the assessee for the purchase or construction of the new asset within the period specified in sub-section (1) been the cost of the new asset, shall be charged under section 45 as income of the previous year in which the period of three years from the date of the transfer of the original asset expires ; and (//) the assessee shall be entitled to withdraw the unutilised amount in accordance with the scheme aforesaid.”

7. Anyhow it is to be seen that the assessee is entitled to get the deduction u/s 54F of the Act amounting to Rs.96,31,350/- in the specific circumstances when the construction has not been completed. In this regard, the matter of controversy has been adjudicated by Hon’ble High ITA. No.1061/Ahd/17 A.Y. 2012-13 Court of Gujarat in case Kishorbhai Harjibhai Patel V/s ITO (2010) 107 Taxman.com 294(Gujrat) in which it is specifically held that the claim u/s 54F of the Act is beneficial provisions and is applicable to the assessee when old capital assets is replaced by new capital assets in form-a residential house. Once an Assessee falls within ambit of beneficial provision, then said provision should be liberally interpreted. The Hon’ble High Court of Karnataka in the case of CIT Vs. Sambandam Udaykumar (2012) 19 taxmann.com 17 has held that the Section 54F is a beneficial provision for promoting the construction of residential house & requires to be construed liberally for achieving that purpose. The intention of the Legislature was to encourage investments in the acquisition of a residential house and completion of construction or occupation is not the requirement of law. The words used in the section are purchased or constructed. The condition precedent for claiming benefit u/s 54F is that the capital gain should be parted by the assessee and invested either in purchasing a residential house or in constructing a residential house. Merely because the sale deed had not been executed or that construction is not complete and it is not in a fit condition to be occupied does not disentitle the assessee to claim section 54F relief. In the said case Sardarmal Kothari 302 ITR 286 (Mad) was followed. There are some decisions on this point such as CIT Vs. Smt. Shashi Verma (1997) 224 ITR 106 in which specifically held that when the assessee has taken the sufficient steps for construction and has invested the amount, therefore, in the said circumstances it would deemed that the assessee has complied with the provisions u/s 54F of the Act. It is also made clear that if the construction was not completed within the prescribed period and the assesssee has invested the amount, therefore, ITA. No.1061/Ahd/17 A.Y. 2012-13 the claim of the assessee is not liable to be declined u/s 54F of the Act. Taking into account all the facts and circumstances, we are of the view that the claim of the assessee has wrongly been denied by CIT(A), therefore, we set aside the finding of the CIT(A) on this issue and allowed the claim of the assessee u/s 54F of the Act. Accordingly, this issue is decided in favour of the assessee against the revenue.

8. In the result, the appeal filed by the assessee is hereby ordered to be allowed.

Order pronounced in the open court on 19/09/2019 Sd/- Sd/-

(MANISH BORAD) (AMARJIT SINGH)

लेखा सदस्य / ACCOUNTANT MEMBER न्यधनिक सदस्य/JUDICIAL MEMBER

Ahmedabad ददनां क Dated : 19/09/2019

Vijay/Sr. PS

आदे श की प्रनिनिनि अग्रेनर्ि/Copy of the Order forwarded to :

1. अपीलाथी / The Appellant

2. प्रत्यथी / The Respondent.

3. आयकर आयु क्त(अपील) / The CIT(A)-

4. आयकर आयु क्त / CIT

5. दवभागीय प्रदतदनदि, आयकर अपीलीय अदिकरण, DR/AR, ITAT, Ahmedabad

6. गार्ड फाईल / Guard file.

आदे शधिुसधर/ BY ORDER, “सत्यादपत प्रदत //True Copy//”

(Assistant Registrar) ITAT, Ahmedabad