दीपावली है दीपों का त्यौहार, घर लाये आपके सुख, समृद्धि और प्यार, Happy Deepawali

PROVISION BEFORE AMENDMENT:

4 Matters not to be dealt with in a Meeting through Video Conferencing or Other Audio-Visual Means

1(1) [The] following matters shall not be dealt with in any meeting held through video conferencing or other audiovisual means.-

(i) The approval of the annual financial statements;

(ii) The approval of the Board’s report;

(iii) The approval of the prospectus;

(iv) The Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any, to be approved by the Board under sub-section (1) of section 134 of the Act]; and

(v) The approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

PROVISION after 1st AMENDMENT:

4 Matters to be Dealt With in a Meeting Through Video Conferencing or Other Audio-Visual Means Upto 30 June 2020.

1(1) [The] following matters shall not be dealt with in any meeting held through video conferencing or other audiovisual means.-

(i) The approval of the annual financial statements;

(ii) The approval of the Board’s report;

(iii) The approval of the prospectus;

(iv) The Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any, to be approved by the Board under sub-section (1) of section 134 of the Act]; and

(v) The approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

1(1) [The] following matters shall not be dealt with in any meeting held through video conferencing or other audiovisual means.-

(i) The approval of the annual financial statements;

(ii) The approval of the Board’s report;

(iii) The approval of the prospectus;

(iv) The Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any, to be approved by the Board under sub-section (1) of section 134 of the Act]; and

(v) the approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

| Subject | Extension of RSUB validity for companies | Time extension as per Circular | Circular Apply Conditions | Example |

| Name reservation for companies | Names reserved for 20 days for new company incorporation. SPICe+ Part B needs to be filed within 20 days of name reservation | Names expiring any day between 15th March 2020 to 30th June would be extended by 20 days beyond 30th June 2020. |

*The name must be Expire between 15th march 2020 to 30th june 2020 | 1.ABC pvt ltd The name reservation expire on 30th june 2020. but due to circular now name expire on 20 July 2020. 2.ABC pvt ltd The name reservation expire on 20th March 2020. but due to circular now name expire on 20 July 2020. 3.ABC pvt ltd The name reservation expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Change of Name of companies | Names reserved for 60 days for change of name of company. INC-24 needs to be filed within 60 days of name reservation. | Names expiring any day between 15th March 2020 to 30th June would be extended by 60 days beyond 30th June 2020. |

*The name must be Expire between 15th march 2020 to 30th june 2020 | 1.ABC pvt ltd The name reservation expire on 30th june 2020. but due to circular now name expire on 29 August 2020. 2.ABC pvt ltd The name reservation expire on 20th March 2020. but due to circular now name expire on 29 August 2020. 3.ABC pvt ltd The name reservation expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Name Resubmition(RSUB) | Extension of RSUB validity for companies/LLPs |

SRNs where last date of Resubmission (RSUB) falls between 15th March 2020 to 30th June 2020, additional 15 days beyond 30th June 2020 would be allowed. However, for SRNs already marked under NTBR, extension would be provided on case to case basis. | *The name Resubmission must expire between 15th march 2020 to 30th june 2020 | 1.ABC pvt ltd The name resubmission expire on 30th june 2020. but due to circular now name expire on 15 July 2020. 2.ABC pvt ltd The name resubmission expire on 20th March 2020. but due to circular now name expire on 15 July 2020. 3.ABC pvt ltd The name resubmission expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Namee reservation for LLPs | Names reserved for 90 days for new LLP incorporation/change of name. FiLLiP/Form 5 needs to be filed within 90 days of name reservation. | Names expiring any day between 15th March 2020 to 30th June would be extended by 20 days beyond 30th June 2020. | *The name Reservation must expire between 15th march 2020 to 30th june 2020 | 1.ABC LLP The name Reservation expire on 30th june 2020. but due to circular now name expire on 20 July 2020. 2.ABC LLP The name reservation expire on 20th March 2020. but due to circular now name expire on 20 July 2020. 3.ABC LLP The name reservation expire on 01 july 2020 then these circular not applies and no time extension allowed. |

Companies Fresh Start Scheme 2020 CFSS-2020

|

|

| Question | Answers |

| Entity | Company / LLP |

| Scheme Name | CFSS, 2020 |

| Which Forms / Return | defaulting Company who failed to file required documents / Forms / Return including annual filing AOC4 / MGT7 / ADT1 |

| One Time Opportunity | One-time waiver of additional filing fees for delayed filings only normal fees need to be paid  |

| Period Start | 01/04/2020 |

| Period End | 30/09/2020 |

| FORMS OR DOCUMENTS | All other documents and company except (CHG-1, CHG4, SH7) all described below |

| Non-applicability | 1. strike off companies, 2. company name already in STK-5 3. Amalgamated Companies 4. Dormant Companies 5. Vanishing Companies 6. Form SH-7 7. Charge Related Forms 8. Companies under Liquidation 9. Companies under CIRP, 10 LLP WHICH APPLIED FOR CLOSURE BY LLP24 |

| An additional benefit for an inactive company | opportunity to inactive company 1. to change the status to the dormant company by filing simple form “MSC-1” or 2. may file STK-2 directly for stike off |

| Dormant Company | he scheme gives an opportunity to inactive companies to get their companies declared as ‘dormant company under Section 455 of the Act by filing a simple application at a normal fee. |

| filing requirement | On any company which need to file documents till 31-08-2020 can file such documents |

| any appeal against prosecution Pending | Need to withdraw that before availing this scheme |

| Immunity certificate | Once delayed form filed need to file CFSS 2020 for taking certificate |

| Last date for Immunity certificate Eform “CFSS-2020” without any fees | after filing forms but not later than 6 months from the closure of scheme 31.03.2021  |

| Prosecution | Immunity from prosecution on companies for filing documents between this period |

| Link | http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf |

| Sec / Rule | 403 and 460 and rule Companies(registration offices and fees), Rules, 2014 |

CFSS-2020 FAQ

To whom this Company fresh startup scheme, 2020 {CFSS,2020} scheme is Applicable ?The Scheme shall be applicable only on “defaulting companies”. My company has not filed annual returns for 2 years whether my company is defaulting company?Yes, As per Defaulting Company means any Company which has made a default in filing of:- What is main USP of the schemes or main benefit of the scheme?Under this scheme all the documents can be filed without additional filing fees for delayed filings, only normal fees need to be paid. Should I avail this scheme at any time like in December, is there any time period prescribed for the Scheme ?No, this scheme need to avail between April 1, 2020 till September 30, 2020. All the pending filings should be done within the currency of the Scheme. Is there any list of forms which are covered under the Scheme ?This scheme covers All the form whose list is available on MCA as this link: http://www.mca.gov.in/Ministry/pdf/CFSS2020_02042020.pdf Whether this scheme is available to those companies also whose annual filing is pending from last 10 years?Yes, This scheme is applicable to all those companies whose annual filing is pending irrespective of any year. Whether such scheme is available to strike off companies also which are strike off by ROC due to non filing of annual return?This scheme will be availed by strike off company only after getting company active through NCLT. Which companies or forms not covered under this scheme?"This scheme does not include the following:- Is there any additional opportunity available to Inactive company also ?The defaulting inactive companies while filing Form CFSS-2020 can simultaneously apply for the following actions: If company has filed form during the period of this scheme than whether prosecution can be file against this company??Immunity from launching of prosecution or proceedings for imposing penalty shall be granted only for those forms that will be filed during the CFSS duration i.e. from April 1, 2020 till September 30, 2020 What would be the effect of immunity???After granting the immunity, the Designated Authority, (Registrar of Companies having jurisdiction over the registered office of the Company) shall withdraw the prosecution(s) Whether scheme shall be applicable to filing of DIR-3 KYC ??Yes, this scheme allows to file DIR-3 KYC/Dir-3 KYC WEB without additional fees. How to take benefit of this scheme if company's all directors are disqualified?In such case need to follow this process:-1. Need to appoint new directors from back end office of ROC 2. Can file form after appointment of new director in company. Whether this scheme will be applicable for E-FORM MGT-14 whose delay in filing more than 300 days ??Yes, scheme can be availed for this form also but need to do condoned this form. Whether CFSS form is compulsory to file by ROC?Yes, all the forms need to filed by the company who has availed such scheme within 6 months of closure of scheme. कंपनियां फ्रेश स्टार्ट स्कीम 2020 CFSS-2020 |

|

| सवाल | जवाब |

| सत्ता | कंपनी / एलएलपी |

| सेशमे नाम | सीएफएसएस, 2020 |

| कौन से फॉर्म / रिटर्न | डिफ़ॉल्ट कंपनी, जो आवश्यक दस्तावेज / फॉर्म / रिटर्न दाखिल करने में विफल रही, जिसमें वार्षिक फाइलिंग AOC4 / MGT7 / ADT1 शामिल है |

| वन टाइम अपॉर्चुनिटी | विलंबित फाइलिंग के लिए अतिरिक्त दाखिल शुल्क की एक बार की छूट केवल सामान्य शुल्क का भुगतान करने की आवश्यकता है |

| अवधि प्रारंभ | 01/04/2020 |

| अवधि समाप्त | 30/09/2020 |

| फार्म या दस्तावेज़ | अन्य सभी दस्तावेज और कंपनी (सीएचजी -1, सीएचजी 4, एसएच 7) को छोड़कर सभी नीचे उतरे |

| गैर applicability | 1. कंपनियों को हड़कंप मचाना, 2. कंपनी का नाम पहले से ही STK-5 3. अमलागेटेड कंपनियां 4. निष्क्रिय कंपनियां 5. लुप्त कंपनियाँ 6. फॉर्म SH-7 7. शुल्क संबंधित प्रपत्र 8. परिसमापन के तहत कंपनी 9. CIRP, 10 के तहत कंपनियां LLP24 द्वारा CLOSURE के लिए एलएलपी WHPL लागू किया गया |

| निष्क्रिय कंपनी के लिए अतिरिक्त लाभ | निष्क्रिय कंपनी के लिए अवसर 1. सरल फॉर्म “MSC-1” दाखिल करके निष्क्रिय कंपनी में स्थिति बदलने के लिए और सीधे STK-2 को स्टाइक के लिए दायर कर सकते हैं |

| निष्क्रिय कंपनी | वह योजना में निष्क्रिय कंपनियों को एक सामान्य शुल्क पर एक साधारण आवेदन दाखिल करके अधिनियम की धारा 455 के तहत अपनी कंपनियों को ‘निष्क्रिय कंपनी’ घोषित करने का अवसर देता है। |

| दाखिल करने की आवश्यकता | किसी भी कंपनी पर जिसे 31-08-2020 तक डिमॉनेट फाइल करने की जरूरत है, ऐसे दस्तावेज दाखिल कर सकते हैं |

| अभियोजन लंबित के खिलाफ कोई अपील | इस योजना का लाभ उठाने से पहले इसे वापस लेने की आवश्यकता है |

| प्रतिरक्षा प्रमाणपत्र | एक बार विलंबित फॉर्म को प्रमाणित करने के लिए सीएफएसएस 2020 दाखिल करने की आवश्यकता होती है |

| बिना किसी शुल्क के इम्युनिटी सर्टिफिकेट “CFSS-2020” के लिए अंतिम तिथि | फॉर्म भरने के बाद लेकिन योजना 31.03.2021 को बंद करने के बाद 6 महीने से अधिक नहीं |

| अभियोग | इस अवधि के बीच दस्तावेज दाखिल करने के लिए कंपनियों पर मुकदमा चलाने से प्रतिरक्षा |

| संपर्क | http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf |

| सेक / नियम | 403 और 460 और नियम कंपनी (पंजीकरण कार्यालय और शुल्क), नियम, 2014 |

કંપનીઓ તાજી શરૂઆત યોજના 2020 સીએફએસએસ -2020 |

|

| પ્રશ્ન | જવાબો |

| એન્ટિટી | કંપની / એલએલપી |

| Scheme નામ | સીએફએસએસ, 2020 |

| કયા ફોર્મ / રીટર્ન | ડિફોલ્ફિંગ કંપની જે વાર્ષિક ફાઇલિંગ એઓસી 4 / એમજીટી 7 / એડીટી 1 સહિત જરૂરી દસ્તાવેજો / ફોર્મ્સ / રીટર્ન ફાઇલ કરવામાં નિષ્ફળ ગઈ |

| એક સમયનો અવસર | વિલંબિત ફાઇલિંગ્સ માટે વધારાની ફાઇલિંગ ફીમાંથી એક સમય માફી, ફક્ત સામાન્ય ફી ચૂકવવાની જરૂર છે |

| પીરિયડ પ્રારંભ | 04/01/2020 |

| પીરિયડ એન્ડ | 9/30/2020 |

| ફોર્મ્સ અથવા દસ્તાવેજો | (સીએચજી -1, સીએચજી 4, એસએચ 7) સિવાયના અન્ય તમામ દસ્તાવેજો અને કંપની નીચે વર્ણવેલ છે |

| નોન-એપ્લીકેબલિટી | એસટીકે-5 માં પહેલેથી જ કંપનીઓનું કામકાજ, 2. કંપનીનું નામ A. સંમિશ્રિત કંપનીઓ D. નિષ્ક્રિય કંપનીઓ V. ગાયબ કંપનીઓ Form. ફોર્મ એસ.એચ. 7.. ચાર્જ સંબંધિત ફોર્મ્સ L. લિક્વિડેશન હેઠળની કંપનીઓ C. સીઆઈઆરપી હેઠળની કંપનીઓ, ૧૦ એલએલપી જે એલએલપી 24 દ્વારા ક્લોઝર માટે એપ્લાય કર્યું |

| નિષ્ક્રિય કંપની માટે વધારાના લાભ | નિષ્ક્રિય કંપનીને તક. 1. સરળ ફોર્મ “એમ.એસ.સી.-1” અથવા 2 ફાઇલ કરીને નિષ્ક્રિય કંપનીમાં સ્થિતિ બદલવાની. |

| નિષ્ક્રિય કંપની | તે યોજના નિષ્ક્રિય કંપનીઓને તેમની કંપનીઓની કલમ 455 હેઠળ નિષ્ક્રિય કંપની તરીકે જાહેર કરવાની સામાન્ય ફી પર સરળ અરજી દાખલ કરીને તક આપે છે. |

| ફાઇલિંગ આવશ્યકતા | કોઈપણ કંપની કે જેને 31-08-22020 સુધી ડોક્યુમટન્સ ફાઇલ કરવાની જરૂર છે તે આવા દસ્તાવેજો ફાઇલ કરી શકે છે |

| કાર્યવાહી સામે કોઈ અપીલ બાકી છે | આ યોજનાનો લાભ લેતા પહેલા તે પાછો ખેંચવાની જરૂર છે |

| પ્રતિરક્ષા પ્રમાણપત્ર | એકવાર વિલંબિત ફોર્મ ભર્યા પછી પ્રમાણપત્ર લેવા માટે સીએફએસએસ 2020 ફાઇલ કરવાની જરૂર છે |

| કોઈપણ ફી વિના ઇમ્યુનિટી સર્ટિફિકેટ ઇફોર્મ “સીએફએસએસ -2020” માટેની છેલ્લી તારીખ | forms૧.૦ scheme.૨૦૧૨ ના બંધ થયા પછી ફોર્મ ભર્યા પછી month મહિના પછી નહીં |

| ફરિયાદી | આ સમયગાળા દરમિયાન દસ્તાવેજો ફાઇલ કરવા માટે કંપનીઓ પર કાર્યવાહીની પ્રતિરક્ષા |

| કડી | http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf |

| સેકંડ / નિયમ | 403 અને 460 અને નિયમ કંપનીઓ (નોંધણી કચેરીઓ અને ફી), નિયમો, 2014 |

MCA One in Life Time Opportunity for Director / Shareholder/ Other Stakeholder of Company / LLP

एमसीए वन इन लाइफ टाइम अवसर के लिए निदेशक / शेयरधारक / कंपनी / एलएलपी के अन्य स्टेक धारक

ડિરેક્ટર / શેરહોલ્ડર / કંપની / એલએલપીના અન્ય હિસ્સો ધારક માટે એમસીએ વન ઇન લાઇફ ટાઇમ તકો NO Additional Fees / Penalty / Prosecution of Filing any form /

NO Additional Fees / Penalty / Prosecution of Filing any form / Return Including DIR-3KYC Which have 5K Penalty ACTIVE -22 Which Have 10K Penalty

अतिरिक्त शुल्क / पेनल्टी / किसी भी फॉर्म को दाखिल करने का अभियोजन / रिटर्न जिसमें DIR-3KYC शामिल है, जिसमें 5K पेनाल्टी ACTIVE -22 है, जिसमें 10K पेनाल्टी है

કોઈ વધારાની ફી / દંડ / ડી.આઇ.આર.-3 કેવાયસી સહિત કોઈપણ ફોર્મ / રિટર્ન ભરવાની કાર્યવાહી જેની પાસે 5 કે દંડની પ્રવૃત્તિ -22 જેમાં 10 કે દંડ છે

EXAMPLE

| TYPE | Existing Additional Fees | CFSS-2020 Scheme | *Approx Saving Per Year Per Company | Action to be Taken |

| COAF AOC4 / MGT | Rs 100 Per Day | NIL | 73000 | Contact Us Now |

| LLPAF LLP11 /LLP | Rs 100 Per Day | NIL | 73000 | Contact Us Now |

| DIR-3-KYC | Rs 5000 | Nil | 10000 | Contact Us Now |

| Active-22 | Rs 10000 | Nil | 10000 | Contact Us Now |

List of Form for Which Additional Fees is waived

| No | Form No. | Description |

| 1 | 23C | Appointment of Cost Auditors |

| 2 | MR-2 | Form of Application to the Central Government for approval of appointment or reappointment and remuneration or increase in remuneration or waiver for excess or over payment to managing director or whole time director or manager and commission or remuneration to directors |

| 3 | ADT-2 | Application for removal of auditor(s) from his/their office before expiry of term |

| 4 | NDH-2 | Application for extension of time |

| 5 | DIR-3C | Intimation of Director Identification Number by the company to the registrar |

| 6 | INC-12 | Application for grant of License under section 8 |

| 7 | MSC-1 | Application to ROC for obtaining the status of dormant company |

| 8 | DIR-12 | Particulars of appointment of directors and the key managerial personnel and the changes among them |

| 9 | INC-4 | Intimation for Change in Member/Nominee |

| 10 | INC-6 | One Person Company – Application for Conversion |

| 11 | INC-22 | Notice of Situation or Change of situation of Registered Office of the Company |

| 12 | INC-27 | Conversion of public company into private company company or private company into public |

| 13 | 20B | Annual Return |

| 14 | 21A | Annual Return for company having no share capital |

| 15 | 23B | Notice by Auditor |

| 16 | 23D | Information by cost auditor to Central Government |

| 17 | 23AC | Filing balance sheet and other documents with the Registrar |

| 18 | 23AC-XBRL | Form for filing XBRL document in respect of balance sheet and other documents with the Registrar. |

| 19 | Form 66 | Form for submission of Compliance Certificate |

| 20 | AOC-4 | Form for filing financial statement and other documents with the Registrar |

| 21 | AOC-4 | |

| CFS | Form for filing consolidated financial statements and other documents with the Registrar | |

| 22 | AOC-4(XBRL) | Form for filing XBRL document in respect of financial statement and other documents with the Registrar |

| 23 | ADT-1 | Information to the Registrar by company for appointment of auditor |

| 24 | ADT-3 | Notice of Resignation by the Auditor |

| 25 | BEN-2 | Return to the Registrar in respect of declaration under section 90 |

| 26 | CRA-2 | Form of Intimation of appointment of cost auditor by the company to Central Government |

| 27 | CRA-4 | Form for filing Cost Audit Report with the Central Government |

| 28 | DPT-3 | Return of deposits |

| 29 | DPT-4 | Statement regarding deposits existing on the commencement of the Act |

| 30 | GNL-2 | Form for submission of documents with the Registrar |

| 31 | INC-5 | One Person Company-Intimation of exceeding threshold |

| 32 | IEPF-1 | Statement of amounts credited to the Investor Education and Protection Fund |

| 33 | IEPF-2 | Statement of unclaimed or unpaid amounts |

| 34 | IEPF-3 | Statement of shares and unclaimed or unpaid dividend not transferred to the Investor Education and Protection Fund |

| 35 | IEPF-4 | Statement of shares transferred to the Investor Education and Protection Fund |

| 36 | IEPF-6 | Statement of unclaimed or unpaid amounts to be transferred to the Investor Education and Protection Fund |

| 37 | IEPF-7 | Statement of amounts credited to IEPF on account of shares transferred to the fund |

| 38 | IEPF-5 e- verificati on report | Application to the authority for claiming unpaid amounts and shares out of Investor Education and Protection Fund (IEPF) – E-verification report |

| 39 | I-XBRL | Form for filing XBRL document in respect of cost audit report and other documents with the Central Government |

| 40 | MGT-7 | Annual Return |

| 41 | MR-1 | Return of appointment of key managerial personnel |

| 42 | MSC-3 | Return of dormant companies |

| 43 | NDH-1 | Return of Statutory Compliances |

| 44 | NDH-3 | Return of Nidhi Company for the half year ended |

| 45 | NDH-4 | Application for declaration as Nidhi Company and for updation of status by Nidhis |

| 46 | PAS-3 | Return of allotment |

| 47 | SH-11 | Return in respect of buy-back of securities |

| 48 | A-XBRL | Form for filing XBRL document in respect of compliance report and other documents with the Central Government |

| 49 | DIR-3 | |

| KYC/Web form | Application for KYC of Directors | |

| 50 | FC-1 | Information to be filled by Foreign company |

| 51 | FC-2 | Return of alteration in the documents filed for registration by foreign company |

| 52 | FC-3 | Annual accounts along with the list of all principal places of business in India established by foreign company |

| 53 | FC-4 | Annual Return of a Foreign Company |

| 54 | INC-22A | Active Company Tagging Identities and Verification (ACTIVE) |

| 55 | INC-20A | Declaration for commencement of business |

| 56 | AOC-5 | Notice of address at which books of account are maintained |

| 57 | DIR-11 | Notice of resignation of a director to the Registrar |

| 58 | GNL-3 | Particulars of person(s) or key managerial personnel charged or specified for the purpose of sub-clause (iii) or (iv) of clause 60 of section 2 |

| 59 | INC-20 | Intimation to Registrar of revocation/surrender of license issued under section 8 |

| 60 | INC-28 | Notice of order of the Court or Tribunal or any other competent authority |

| 61 | MGT-6 | Return to the Registrar in respect of declaration under section 89 received by the company |

| 62 | MGT-10 | Changes in shareholding position of promoters and top ten shareholders |

| 63 | MGT-14 | Filing of Resolutions and agreements to the Registrar under section 117 |

| 64 | MGT-15 | Form for filing Report on Annual General Meeting |

| 65 | Form 27 LLP | Form for registration of particulars by Foreign Limited Liability Partnership (FLLP |

| 66 | FORM 3 | Information with regard to limited liability partnership agreement and changes, if any, made therein |

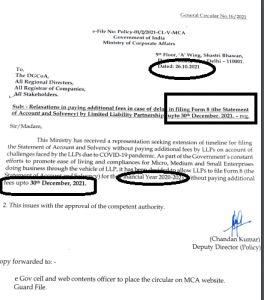

| 67 | FORM 8 | Statement of Account & Solvency |

| 68 | FORM 15 | Notice for change of place of registered office |

| 69 | FORM 11 | Annual Return of Limited Liability Partnership (LLP) |

| 70 | FORM 4 | Notice of appointment, cessation, change in name/ address/designation of a designated partner or partner and consent to become a partner/designated partner |

| 71 | FORM 5 | Notice for change of name |

| 72 | FORM 12 | Form for intimating other address for service of documents |

| 73 | FORM 22 | Notice of intimation of Order of Court/ Tribunal/CLB/ Central Government to the Registrar |

| 74 | FORM 31 | Application for compounding of an offence under the Act |

| 75 | FORM 23 | Application for direction to Limited Liability Partnership (LLP) to change its name to the Registrar |

| 76 | Form 29 LLP | Notice of (A) alteration in the certificate of incorporation or registration; (B) alteration in names and addresses of any of the persons authorised to accept service on behalf of a foreign limited liability partnership (FLLP) (C) alteration in the principal place of business in India of FLLP (D) cessation to have a place of business in India |

The Ministry of Corporate Affairs has decided to take the following special measures for the Companies and LLPs in order to address COVID-19 threat:

No additional fees shall be charged for late filing during a moratorium period from 01sr April to 30th September 2020, in respect of any document, return, statement etc., required to be filed in the MCA-21 Registry, irrespective of its due date, which will not only reduce the compliance burden, including financial burden of companies/ LLPs at large but also enable long-standing noncompliant companies/ LLPs to make a ‘fresh start’.

The mandatory requirement of holding meetings of the Board of the companies within the prescribed interval provided in the Companies Act (120 days), 2013, shall be extended by a period of 60 days till next two quarters i.e., till 30th September.

Applicability of Companies (Auditor’s Report) Order, 2020 shall be made applicable from the financial year 2020-2021 instead of from 2019-2020 notified earlier. This will significantly ease the burden on companies & their auditors for the year 2019-20.

As per Schedule 4 to the Companies Act, 2013, Independent Directors are required to hold at least one meeting without the attendance of non-independent directors and members of management. For the year 2019-20, if the IDs of a company have not been able to hold even one meeting, the same shall not be viewed as a violation.

The requirement to create a Deposit reserve of 20% of deposits maturing during the financial year 2020-21 before 30th April 2020 shall be allowed to be complied with till 30th June 2020.

The requirement to invest 15% of debentures maturing during a particular year in specified instruments before 30th April 2020, may be done so before 30th June 2020.

Newly incorporated companies are required to file a declaration for Commencement of Business within 6 months of incorporation. An additional time of 6 more months shall be allowed.

Non-compliance of minimum residency in India for a period of at least 182 days by at least one director of every company, under Section 149 of the Companies Act, shall not be treated as a violation.

Stakeholders may please note that there is no fee applicable for FORM CAR (Companies Affirmation of Readiness Towards COVID-19).  SHs may also please note that the form has been deployed as a purely confidence-building measure to assess the readiness of the companies to deal with COVID-19 Threat in India. As such no penalty or enforcement-related action is applicable. Stakeholders may at their convenience file this form. It is purely voluntary as part of our contribution towards joining the movement to fight against the spread of the disease. Since the portal may experience heavy load, it would indicate ‘Busy’ alert whenever peak traffic is reached.

SHs may also please note that the form has been deployed as a purely confidence-building measure to assess the readiness of the companies to deal with COVID-19 Threat in India. As such no penalty or enforcement-related action is applicable. Stakeholders may at their convenience file this form. It is purely voluntary as part of our contribution towards joining the movement to fight against the spread of the disease. Since the portal may experience heavy load, it would indicate ‘Busy’ alert whenever peak traffic is reached.

ACTION TO BE TAKEN >>>>

(1) Kindly Confirm Company / LLP Name

(2) Name of Director (MCA KYC Linked Mobile No )