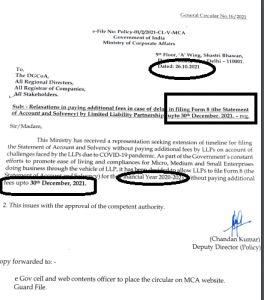

MCA Extension in Filing Fees Upto 31-12-2021 For the year Ended 31-3-2021

PROVISION BEFORE AMENDMENT:

4 Matters not to be dealt with in a Meeting through Video Conferencing or Other Audio-Visual Means

1(1) [The] following matters shall not be dealt with in any meeting held through video conferencing or other audiovisual means.-

(i) The approval of the annual financial statements;

(ii) The approval of the Board’s report;

(iii) The approval of the prospectus;

(iv) The Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any, to be approved by the Board under sub-section (1) of section 134 of the Act]; and

(v) The approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

PROVISION after 1st AMENDMENT:

4 Matters to be Dealt With in a Meeting Through Video Conferencing or Other Audio-Visual Means Upto 30 June 2020.

1(1) [The] following matters shall not be dealt with in any meeting held through video conferencing or other audiovisual means.-

(i) The approval of the annual financial statements;

(ii) The approval of the Board’s report;

(iii) The approval of the prospectus;

(iv) The Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any, to be approved by the Board under sub-section (1) of section 134 of the Act]; and

(v) The approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

1(1) [The] following matters shall not be dealt with in any meeting held through video conferencing or other audiovisual means.-

(i) The approval of the annual financial statements;

(ii) The approval of the Board’s report;

(iii) The approval of the prospectus;

(iv) The Audit Committee Meetings for 2[consideration of financial statement including consolidated financial statement if any, to be approved by the Board under sub-section (1) of section 134 of the Act]; and

(v) the approval of the matter relating to amalgamation, merger, demerger, acquisition and takeover.

Actually provision For appointed as an independent director.

(1) Every individual –

(a) who has been appointed as an independent director in a company, on the date of commencement of the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2019, shall within a period of 5[seven months] from such commencement; or

(b) Who intends to get appointed as an independent director in a company after such commencement, shall before such appointment,

Apply online to the institute for inclusion of his name in the data bank for a period of one year or five years or for his life-time, and from time to time take steps as specified in sub-rule (2), till he continues to hold the office of an independent director in any company:

Provided that any individual, including an individual not having DIN, may voluntarily apply to the institute for inclusion of his name in the data bank.

*Commencement date was: 01 December 2019.

Provision For appointed as an independent director After Amendment date 24/06/2020.

(1) Every individual –

(a) who has been appointed as an independent director in a company, on the date of commencement of the Companies (Appointment and Qualification of Directors) Fifth Amendment Rules, 2019, shall within a period of 5[Ten months] from such commencement; or

(b) Who intends to get appointed as an independent director in a company after such commencement, shall before such appointment,

Apply online to the institute for inclusion of his name in the data bank for a period of one year or five years or for his life-time, and from time to time take steps as specified in sub-rule (2), till he continues to hold the office of an independent director in any company:

Provided that any individual, including an individual not having DIN, may voluntarily apply to the institute for inclusion of his name in the data bank.

*Commencement date was: 01 December 2019.

| Subject | Extension of RSUB validity for companies | Time extension as per Circular | Circular Apply Conditions | Example |

| Name reservation for companies | Names reserved for 20 days for new company incorporation. SPICe+ Part B needs to be filed within 20 days of name reservation | Names expiring any day between 15th March 2020 to 30th June would be extended by 20 days beyond 30th June 2020. |

*The name must be Expire between 15th march 2020 to 30th june 2020 | 1.ABC pvt ltd The name reservation expire on 30th june 2020. but due to circular now name expire on 20 July 2020. 2.ABC pvt ltd The name reservation expire on 20th March 2020. but due to circular now name expire on 20 July 2020. 3.ABC pvt ltd The name reservation expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Change of Name of companies | Names reserved for 60 days for change of name of company. INC-24 needs to be filed within 60 days of name reservation. | Names expiring any day between 15th March 2020 to 30th June would be extended by 60 days beyond 30th June 2020. |

*The name must be Expire between 15th march 2020 to 30th june 2020 | 1.ABC pvt ltd The name reservation expire on 30th june 2020. but due to circular now name expire on 29 August 2020. 2.ABC pvt ltd The name reservation expire on 20th March 2020. but due to circular now name expire on 29 August 2020. 3.ABC pvt ltd The name reservation expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Name Resubmition(RSUB) | Extension of RSUB validity for companies/LLPs |

SRNs where last date of Resubmission (RSUB) falls between 15th March 2020 to 30th June 2020, additional 15 days beyond 30th June 2020 would be allowed. However, for SRNs already marked under NTBR, extension would be provided on case to case basis. | *The name Resubmission must expire between 15th march 2020 to 30th june 2020 | 1.ABC pvt ltd The name resubmission expire on 30th june 2020. but due to circular now name expire on 15 July 2020. 2.ABC pvt ltd The name resubmission expire on 20th March 2020. but due to circular now name expire on 15 July 2020. 3.ABC pvt ltd The name resubmission expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Namee reservation for LLPs | Names reserved for 90 days for new LLP incorporation/change of name. FiLLiP/Form 5 needs to be filed within 90 days of name reservation. | Names expiring any day between 15th March 2020 to 30th June would be extended by 20 days beyond 30th June 2020. | *The name Reservation must expire between 15th march 2020 to 30th june 2020 | 1.ABC LLP The name Reservation expire on 30th june 2020. but due to circular now name expire on 20 July 2020. 2.ABC LLP The name reservation expire on 20th March 2020. but due to circular now name expire on 20 July 2020. 3.ABC LLP The name reservation expire on 01 july 2020 then these circular not applies and no time extension allowed. |

| Questions | Answers |

| If Charge create or modify time limit of 120 days Expire on or before 29/02/2020 then Can we took benefit of these circular? | No, Example:ABC ltd charge create or modify on or before 01/11/2019 then such company not taken benefit of these circular. |

| Can these circular benefits take when on 29/02/2020, charge creation or modification 119 days count or expire? | Yes |

| No days count from 01/03/2020 to 30/09/2020 on charge creation or modification? | Yes |

| Can normal fees Charge when charge create or modify between 01/03/2020 to 30/09/2020 | Yes |

| Can the same amount of fees charge until 30/09/2020 that is fee charge on 29/02/2020 when 120 days not expire on 29/02/2020? | Yes, same fee charge that is charge on 29/02/2020 |

| These circular applies on which forms? | *CHG-1 *CHG-9 |

| Can these circular Applies on the satisfaction of charge in form chg-4 | No, these circular not apply on the satisfaction of charge |

| Can circular apply on charge create or modify on debentures? | Yes Applies |

| How many days count on a charge if charge create or modify on 01/03/2020 | No single day count until 30/09/2020 |

| How many days count on a charge if charge create or modify on 29/02/2020 | 1Day count until 30/09/2020 |

| Can any fees charge for taken these circular benefit | No, Any amount of fees no charge |

| Can any form is required to file for Taken these circular benefit? | No, these circular automatic applies on All companies no additional form is required to charge. |

| What is the effective date of these circular | This circular was immediate effective from 17/06/2020. |

| What is the cutoff date of these circular | Cut off date was 30/09/2020 |

| What charge creation or modification cover on these circular? | All charges cover whose 120 days not expire on 29/02/2020 |

| Conclusion 1. From 01/03/2020 to 30/09/2020 Days not count in Charge Creation or Modification time limit. 2.The charge created before 01/03/2020 must have under time under 120 days as on 29/02/2020, and fee that is charged on 29/02/2020 same fees charge from 01/03/2020 until 30/09/2020. 3.charge created between 01/03/2020 to 30/09/2020 normal fees charge until 30/09/2020. 4.Applies only on form CHG-1 (for creation or modification of charge other than debentures)And Form CHG-9 (for creation or modification of charge on debentures) 5.satisfaction of charge (CHG-4) excluded from these circular. 6.When on 29/02/2020 charge creation or modification time expires then these circular not applicable |

|

FAQ

CONDUCTING EXTRAORDINARY GENERAL MEETING THROUGH VIDEO CONFERENCING OR OTHER AUDIO VISUAL MEANS

Through Video conferencing (VC) or Audio visual means (OVAM).

Not applicable on Annual general meeting, All the items of ordinary business and items where any person has a right to be heard.

NO, such a facility can be availed by those companies also on which Sec. 108 and 110 is not applicable.

applicable on all companies such as Listed, Private, Public, Small etc.

Along with meeting all disclosures, inspection of related documents by members, or authorizations for voting by bodies corporate etc. as provided in the Act and the articles of association of the company are made through electronic mode

The procedure divided into two types of companies:- (A) For Companies which are required to provide the facility of e-voting under the Act, *or any other company which has opted for such facility (B) For Companies which are not required to provide the facility of e-voting under the Act

1. Meeting shall be recorded and the transcript, Recordings of such meeting shall be kept in the safe custody of company.

2. In case of public company having website then such transcripts need to make available on that website also.

Note: no requirement to publish the recorded transcript by private company.

1. Must allows two-way teleconferencing or WebEx for ease of participation

2. Facility to participants to pose questions concurrently or given time to submit their questions in advance in the e-mail address.

3. CAPACITY:

a. FOR PART A COMPANY: Such facility must have a capacity to allow at least 1000 members to participate on first come first serve basis.

b. FOR PART B COMPANY: Such facility must have a capacity to allow at least 500 members or members equal to the total number of members of the Company (whichever is lower) to participate on first come first serve basis.

The large shareholders (i.e., shareholders holding 2% or more shareholdings), promoters, institutional investors, directors, key managerial personnel, the chairpersons of Audit Committee, Nomination and Remuneration Committee and Stakeholders Relationship Committee, auditors etc. may be allowed to attend the meeting without restriction on account of first come first serve basis.

Facility for join the meeting shall be open at least 15 minute before the time to start meeting and shall be open till 15 minute after the expiry of schedule time.

Yes, and the quorum will be counted as per section 103 of companies Act, 2013.

1. Only those members, who are present in the meeting through VC or OAVM facility and have not cast their vote on resolutions through remote e-voting and are otherwise not barred from doing so, shall be allowed to vote through e-voting system or by a show of hands in the meeting.

2. Before the actual date of the meeting, the facility of remote e-voting shall be provided in accordance with the act and the rules.

1. The Company shall provide a designated e-mail address to all members at the time of sending the notice of meeting so that the members can convey their vote, when a poll is required to be taken during the meeting on any resolution, at such designated email address.

2. During the meeting held through VC or OAVM facilities, where a poll on any item is required, the members shall cast their vote on the resolutions only by sending emails through their email address which are registered with the company. The said email shall only be sent to the designated email address circulated by the company in advance.

3. The confidentiality of the password and other privacy issues associated with the designated e-mails shall be strictly maintained by the company at all times. Due safeguards with regards to authenticity of email address(as) and other details shall be taken by the company.

1. If prescribed in the AOA then as per article.

2. If not prescribed, then:-

a. where there are less than 50 members present at the meeting, the Chairman shall be appointed in accordance with Section 104;

b. in all other cases, the Chairman shall be appointed by a poll through E-voting

1. If prescribed in the AOA then as per article.

2. If not prescribed, then:-

a. where there are less than 50 members present at the meeting, the Chairman shall be appointed in accordance with Section 104;

b. in all other cases, the Chairman shall be appointed by a poll conducted through Email as procedure followed for voting by poll.

NO, Proxy is not allowed to appoint in such meeting. However AR can be appointed for such meeting as per requirements.

1. The Chairman of the meeting must ensure that the facility of e-voting system is available for the purpose of conducting a poll during the meeting

2. Voting manner depends on the number of members present in such meeting, :-

a. where there are less than 50 members present at the meeting, the voting may be conducted either through the e-voting system or by a show of hands, unless a demand for poll is made in accordance with section 5109 of the Act,

b. Once poll demanded the voting shall be conducted through the e-voting system;

c. In all other cases, the voting shall be conducted through e-voting system

1. Where less than 50 members are present in a meeting, the chairman may decide to conduct a vote by show of hands, unless a demand for poll is made

2. Once such demand is made, the procedures of voting through designated e-mail by the members on provided e-mail ID of the Company is to be followed.

3. In case the counting of votes requires time, the said meeting may be adjourned and called later to declare the result.

4. In other cases procedures of voting through designated e-mail by the members on provided e-mail ID of the Company

IT is compulsory For at least one independent director (if appointed), and the auditor or his authorized representative, who is qualified to be the auditor.

If II is members they are encouraged to attend the meeting and cast votes.

1. The notice for the general meeting shall make disclosures with regard to the manner in which framework provided in this Circular shall be available for use by the members and

2. It Also contain clear instructions on how to access and participate in the meeting.

3. The Company shall also provide a helpline number through the registrar & transfer agent, technology provider, or otherwise, for those shareholders who need assistance with using the technology before or during the meeting. (FOR PART A COMPANY).

4. Company must provide Email address in the notice so that member can send their vote in case of voting done through poll. (FOR PART B company)

5. A copy of the meeting notice shall also be prominently displayed on the website of the company and due intimation may be made to the exchanges in case of a listed company

The company can adopt such circular by taking approval of members as per sec 101 of company act, 2013

All companies need to inform to ROC within 60 days of meeting.

Companies Fresh Start Scheme 2020 CFSS-2020

|

|

| Question | Answers |

| Entity | Company / LLP |

| Scheme Name | CFSS, 2020 |

| Which Forms / Return | defaulting Company who failed to file required documents / Forms / Return including annual filing AOC4 / MGT7 / ADT1 |

| One Time Opportunity | One-time waiver of additional filing fees for delayed filings only normal fees need to be paid  |

| Period Start | 01/04/2020 |

| Period End | 30/09/2020 |

| FORMS OR DOCUMENTS | All other documents and company except (CHG-1, CHG4, SH7) all described below |

| Non-applicability | 1. strike off companies, 2. company name already in STK-5 3. Amalgamated Companies 4. Dormant Companies 5. Vanishing Companies 6. Form SH-7 7. Charge Related Forms 8. Companies under Liquidation 9. Companies under CIRP, 10 LLP WHICH APPLIED FOR CLOSURE BY LLP24 |

| An additional benefit for an inactive company | opportunity to inactive company 1. to change the status to the dormant company by filing simple form “MSC-1” or 2. may file STK-2 directly for stike off |

| Dormant Company | he scheme gives an opportunity to inactive companies to get their companies declared as ‘dormant company under Section 455 of the Act by filing a simple application at a normal fee. |

| filing requirement | On any company which need to file documents till 31-08-2020 can file such documents |

| any appeal against prosecution Pending | Need to withdraw that before availing this scheme |

| Immunity certificate | Once delayed form filed need to file CFSS 2020 for taking certificate |

| Last date for Immunity certificate Eform “CFSS-2020” without any fees | after filing forms but not later than 6 months from the closure of scheme 31.03.2021  |

| Prosecution | Immunity from prosecution on companies for filing documents between this period |

| Link | http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf |

| Sec / Rule | 403 and 460 and rule Companies(registration offices and fees), Rules, 2014 |

CFSS-2020 FAQ

To whom this Company fresh startup scheme, 2020 {CFSS,2020} scheme is Applicable ?The Scheme shall be applicable only on “defaulting companies”. My company has not filed annual returns for 2 years whether my company is defaulting company?Yes, As per Defaulting Company means any Company which has made a default in filing of:- What is main USP of the schemes or main benefit of the scheme?Under this scheme all the documents can be filed without additional filing fees for delayed filings, only normal fees need to be paid. Should I avail this scheme at any time like in December, is there any time period prescribed for the Scheme ?No, this scheme need to avail between April 1, 2020 till September 30, 2020. All the pending filings should be done within the currency of the Scheme. Is there any list of forms which are covered under the Scheme ?This scheme covers All the form whose list is available on MCA as this link: http://www.mca.gov.in/Ministry/pdf/CFSS2020_02042020.pdf Whether this scheme is available to those companies also whose annual filing is pending from last 10 years?Yes, This scheme is applicable to all those companies whose annual filing is pending irrespective of any year. Whether such scheme is available to strike off companies also which are strike off by ROC due to non filing of annual return?This scheme will be availed by strike off company only after getting company active through NCLT. Which companies or forms not covered under this scheme?"This scheme does not include the following:- Is there any additional opportunity available to Inactive company also ?The defaulting inactive companies while filing Form CFSS-2020 can simultaneously apply for the following actions: If company has filed form during the period of this scheme than whether prosecution can be file against this company??Immunity from launching of prosecution or proceedings for imposing penalty shall be granted only for those forms that will be filed during the CFSS duration i.e. from April 1, 2020 till September 30, 2020 What would be the effect of immunity???After granting the immunity, the Designated Authority, (Registrar of Companies having jurisdiction over the registered office of the Company) shall withdraw the prosecution(s) Whether scheme shall be applicable to filing of DIR-3 KYC ??Yes, this scheme allows to file DIR-3 KYC/Dir-3 KYC WEB without additional fees. How to take benefit of this scheme if company's all directors are disqualified?In such case need to follow this process:-1. Need to appoint new directors from back end office of ROC 2. Can file form after appointment of new director in company. Whether this scheme will be applicable for E-FORM MGT-14 whose delay in filing more than 300 days ??Yes, scheme can be availed for this form also but need to do condoned this form. Whether CFSS form is compulsory to file by ROC?Yes, all the forms need to filed by the company who has availed such scheme within 6 months of closure of scheme. कंपनियां फ्रेश स्टार्ट स्कीम 2020 CFSS-2020 |

|

| सवाल | जवाब |

| सत्ता | कंपनी / एलएलपी |

| सेशमे नाम | सीएफएसएस, 2020 |

| कौन से फॉर्म / रिटर्न | डिफ़ॉल्ट कंपनी, जो आवश्यक दस्तावेज / फॉर्म / रिटर्न दाखिल करने में विफल रही, जिसमें वार्षिक फाइलिंग AOC4 / MGT7 / ADT1 शामिल है |

| वन टाइम अपॉर्चुनिटी | विलंबित फाइलिंग के लिए अतिरिक्त दाखिल शुल्क की एक बार की छूट केवल सामान्य शुल्क का भुगतान करने की आवश्यकता है |

| अवधि प्रारंभ | 01/04/2020 |

| अवधि समाप्त | 30/09/2020 |

| फार्म या दस्तावेज़ | अन्य सभी दस्तावेज और कंपनी (सीएचजी -1, सीएचजी 4, एसएच 7) को छोड़कर सभी नीचे उतरे |

| गैर applicability | 1. कंपनियों को हड़कंप मचाना, 2. कंपनी का नाम पहले से ही STK-5 3. अमलागेटेड कंपनियां 4. निष्क्रिय कंपनियां 5. लुप्त कंपनियाँ 6. फॉर्म SH-7 7. शुल्क संबंधित प्रपत्र 8. परिसमापन के तहत कंपनी 9. CIRP, 10 के तहत कंपनियां LLP24 द्वारा CLOSURE के लिए एलएलपी WHPL लागू किया गया |

| निष्क्रिय कंपनी के लिए अतिरिक्त लाभ | निष्क्रिय कंपनी के लिए अवसर 1. सरल फॉर्म “MSC-1” दाखिल करके निष्क्रिय कंपनी में स्थिति बदलने के लिए और सीधे STK-2 को स्टाइक के लिए दायर कर सकते हैं |

| निष्क्रिय कंपनी | वह योजना में निष्क्रिय कंपनियों को एक सामान्य शुल्क पर एक साधारण आवेदन दाखिल करके अधिनियम की धारा 455 के तहत अपनी कंपनियों को ‘निष्क्रिय कंपनी’ घोषित करने का अवसर देता है। |

| दाखिल करने की आवश्यकता | किसी भी कंपनी पर जिसे 31-08-2020 तक डिमॉनेट फाइल करने की जरूरत है, ऐसे दस्तावेज दाखिल कर सकते हैं |

| अभियोजन लंबित के खिलाफ कोई अपील | इस योजना का लाभ उठाने से पहले इसे वापस लेने की आवश्यकता है |

| प्रतिरक्षा प्रमाणपत्र | एक बार विलंबित फॉर्म को प्रमाणित करने के लिए सीएफएसएस 2020 दाखिल करने की आवश्यकता होती है |

| बिना किसी शुल्क के इम्युनिटी सर्टिफिकेट “CFSS-2020” के लिए अंतिम तिथि | फॉर्म भरने के बाद लेकिन योजना 31.03.2021 को बंद करने के बाद 6 महीने से अधिक नहीं |

| अभियोग | इस अवधि के बीच दस्तावेज दाखिल करने के लिए कंपनियों पर मुकदमा चलाने से प्रतिरक्षा |

| संपर्क | http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf |

| सेक / नियम | 403 और 460 और नियम कंपनी (पंजीकरण कार्यालय और शुल्क), नियम, 2014 |

કંપનીઓ તાજી શરૂઆત યોજના 2020 સીએફએસએસ -2020 |

|

| પ્રશ્ન | જવાબો |

| એન્ટિટી | કંપની / એલએલપી |

| Scheme નામ | સીએફએસએસ, 2020 |

| કયા ફોર્મ / રીટર્ન | ડિફોલ્ફિંગ કંપની જે વાર્ષિક ફાઇલિંગ એઓસી 4 / એમજીટી 7 / એડીટી 1 સહિત જરૂરી દસ્તાવેજો / ફોર્મ્સ / રીટર્ન ફાઇલ કરવામાં નિષ્ફળ ગઈ |

| એક સમયનો અવસર | વિલંબિત ફાઇલિંગ્સ માટે વધારાની ફાઇલિંગ ફીમાંથી એક સમય માફી, ફક્ત સામાન્ય ફી ચૂકવવાની જરૂર છે |

| પીરિયડ પ્રારંભ | 04/01/2020 |

| પીરિયડ એન્ડ | 9/30/2020 |

| ફોર્મ્સ અથવા દસ્તાવેજો | (સીએચજી -1, સીએચજી 4, એસએચ 7) સિવાયના અન્ય તમામ દસ્તાવેજો અને કંપની નીચે વર્ણવેલ છે |

| નોન-એપ્લીકેબલિટી | એસટીકે-5 માં પહેલેથી જ કંપનીઓનું કામકાજ, 2. કંપનીનું નામ A. સંમિશ્રિત કંપનીઓ D. નિષ્ક્રિય કંપનીઓ V. ગાયબ કંપનીઓ Form. ફોર્મ એસ.એચ. 7.. ચાર્જ સંબંધિત ફોર્મ્સ L. લિક્વિડેશન હેઠળની કંપનીઓ C. સીઆઈઆરપી હેઠળની કંપનીઓ, ૧૦ એલએલપી જે એલએલપી 24 દ્વારા ક્લોઝર માટે એપ્લાય કર્યું |

| નિષ્ક્રિય કંપની માટે વધારાના લાભ | નિષ્ક્રિય કંપનીને તક. 1. સરળ ફોર્મ “એમ.એસ.સી.-1” અથવા 2 ફાઇલ કરીને નિષ્ક્રિય કંપનીમાં સ્થિતિ બદલવાની. |

| નિષ્ક્રિય કંપની | તે યોજના નિષ્ક્રિય કંપનીઓને તેમની કંપનીઓની કલમ 455 હેઠળ નિષ્ક્રિય કંપની તરીકે જાહેર કરવાની સામાન્ય ફી પર સરળ અરજી દાખલ કરીને તક આપે છે. |

| ફાઇલિંગ આવશ્યકતા | કોઈપણ કંપની કે જેને 31-08-22020 સુધી ડોક્યુમટન્સ ફાઇલ કરવાની જરૂર છે તે આવા દસ્તાવેજો ફાઇલ કરી શકે છે |

| કાર્યવાહી સામે કોઈ અપીલ બાકી છે | આ યોજનાનો લાભ લેતા પહેલા તે પાછો ખેંચવાની જરૂર છે |

| પ્રતિરક્ષા પ્રમાણપત્ર | એકવાર વિલંબિત ફોર્મ ભર્યા પછી પ્રમાણપત્ર લેવા માટે સીએફએસએસ 2020 ફાઇલ કરવાની જરૂર છે |

| કોઈપણ ફી વિના ઇમ્યુનિટી સર્ટિફિકેટ ઇફોર્મ “સીએફએસએસ -2020” માટેની છેલ્લી તારીખ | forms૧.૦ scheme.૨૦૧૨ ના બંધ થયા પછી ફોર્મ ભર્યા પછી month મહિના પછી નહીં |

| ફરિયાદી | આ સમયગાળા દરમિયાન દસ્તાવેજો ફાઇલ કરવા માટે કંપનીઓ પર કાર્યવાહીની પ્રતિરક્ષા |

| કડી | http://www.mca.gov.in/Ministry/pdf/Circular12_30032020.pdf |

| સેકંડ / નિયમ | 403 અને 460 અને નિયમ કંપનીઓ (નોંધણી કચેરીઓ અને ફી), નિયમો, 2014 |

MCA One in Life Time Opportunity for Director / Shareholder/ Other Stakeholder of Company / LLP

एमसीए वन इन लाइफ टाइम अवसर के लिए निदेशक / शेयरधारक / कंपनी / एलएलपी के अन्य स्टेक धारक

ડિરેક્ટર / શેરહોલ્ડર / કંપની / એલએલપીના અન્ય હિસ્સો ધારક માટે એમસીએ વન ઇન લાઇફ ટાઇમ તકો NO Additional Fees / Penalty / Prosecution of Filing any form /

NO Additional Fees / Penalty / Prosecution of Filing any form / Return Including DIR-3KYC Which have 5K Penalty ACTIVE -22 Which Have 10K Penalty

अतिरिक्त शुल्क / पेनल्टी / किसी भी फॉर्म को दाखिल करने का अभियोजन / रिटर्न जिसमें DIR-3KYC शामिल है, जिसमें 5K पेनाल्टी ACTIVE -22 है, जिसमें 10K पेनाल्टी है

કોઈ વધારાની ફી / દંડ / ડી.આઇ.આર.-3 કેવાયસી સહિત કોઈપણ ફોર્મ / રિટર્ન ભરવાની કાર્યવાહી જેની પાસે 5 કે દંડની પ્રવૃત્તિ -22 જેમાં 10 કે દંડ છે

EXAMPLE

| TYPE | Existing Additional Fees | CFSS-2020 Scheme | *Approx Saving Per Year Per Company | Action to be Taken |

| COAF AOC4 / MGT | Rs 100 Per Day | NIL | 73000 | Contact Us Now |

| LLPAF LLP11 /LLP | Rs 100 Per Day | NIL | 73000 | Contact Us Now |

| DIR-3-KYC | Rs 5000 | Nil | 10000 | Contact Us Now |

| Active-22 | Rs 10000 | Nil | 10000 | Contact Us Now |

List of Form for Which Additional Fees is waived

| No | Form No. | Description |

| 1 | 23C | Appointment of Cost Auditors |

| 2 | MR-2 | Form of Application to the Central Government for approval of appointment or reappointment and remuneration or increase in remuneration or waiver for excess or over payment to managing director or whole time director or manager and commission or remuneration to directors |

| 3 | ADT-2 | Application for removal of auditor(s) from his/their office before expiry of term |

| 4 | NDH-2 | Application for extension of time |

| 5 | DIR-3C | Intimation of Director Identification Number by the company to the registrar |

| 6 | INC-12 | Application for grant of License under section 8 |

| 7 | MSC-1 | Application to ROC for obtaining the status of dormant company |

| 8 | DIR-12 | Particulars of appointment of directors and the key managerial personnel and the changes among them |

| 9 | INC-4 | Intimation for Change in Member/Nominee |

| 10 | INC-6 | One Person Company – Application for Conversion |

| 11 | INC-22 | Notice of Situation or Change of situation of Registered Office of the Company |

| 12 | INC-27 | Conversion of public company into private company company or private company into public |

| 13 | 20B | Annual Return |

| 14 | 21A | Annual Return for company having no share capital |

| 15 | 23B | Notice by Auditor |

| 16 | 23D | Information by cost auditor to Central Government |

| 17 | 23AC | Filing balance sheet and other documents with the Registrar |

| 18 | 23AC-XBRL | Form for filing XBRL document in respect of balance sheet and other documents with the Registrar. |

| 19 | Form 66 | Form for submission of Compliance Certificate |

| 20 | AOC-4 | Form for filing financial statement and other documents with the Registrar |

| 21 | AOC-4 | |

| CFS | Form for filing consolidated financial statements and other documents with the Registrar | |

| 22 | AOC-4(XBRL) | Form for filing XBRL document in respect of financial statement and other documents with the Registrar |

| 23 | ADT-1 | Information to the Registrar by company for appointment of auditor |

| 24 | ADT-3 | Notice of Resignation by the Auditor |

| 25 | BEN-2 | Return to the Registrar in respect of declaration under section 90 |

| 26 | CRA-2 | Form of Intimation of appointment of cost auditor by the company to Central Government |

| 27 | CRA-4 | Form for filing Cost Audit Report with the Central Government |

| 28 | DPT-3 | Return of deposits |

| 29 | DPT-4 | Statement regarding deposits existing on the commencement of the Act |

| 30 | GNL-2 | Form for submission of documents with the Registrar |

| 31 | INC-5 | One Person Company-Intimation of exceeding threshold |

| 32 | IEPF-1 | Statement of amounts credited to the Investor Education and Protection Fund |

| 33 | IEPF-2 | Statement of unclaimed or unpaid amounts |

| 34 | IEPF-3 | Statement of shares and unclaimed or unpaid dividend not transferred to the Investor Education and Protection Fund |

| 35 | IEPF-4 | Statement of shares transferred to the Investor Education and Protection Fund |

| 36 | IEPF-6 | Statement of unclaimed or unpaid amounts to be transferred to the Investor Education and Protection Fund |

| 37 | IEPF-7 | Statement of amounts credited to IEPF on account of shares transferred to the fund |

| 38 | IEPF-5 e- verificati on report | Application to the authority for claiming unpaid amounts and shares out of Investor Education and Protection Fund (IEPF) – E-verification report |

| 39 | I-XBRL | Form for filing XBRL document in respect of cost audit report and other documents with the Central Government |

| 40 | MGT-7 | Annual Return |

| 41 | MR-1 | Return of appointment of key managerial personnel |

| 42 | MSC-3 | Return of dormant companies |

| 43 | NDH-1 | Return of Statutory Compliances |

| 44 | NDH-3 | Return of Nidhi Company for the half year ended |

| 45 | NDH-4 | Application for declaration as Nidhi Company and for updation of status by Nidhis |

| 46 | PAS-3 | Return of allotment |

| 47 | SH-11 | Return in respect of buy-back of securities |

| 48 | A-XBRL | Form for filing XBRL document in respect of compliance report and other documents with the Central Government |

| 49 | DIR-3 | |

| KYC/Web form | Application for KYC of Directors | |

| 50 | FC-1 | Information to be filled by Foreign company |

| 51 | FC-2 | Return of alteration in the documents filed for registration by foreign company |

| 52 | FC-3 | Annual accounts along with the list of all principal places of business in India established by foreign company |

| 53 | FC-4 | Annual Return of a Foreign Company |

| 54 | INC-22A | Active Company Tagging Identities and Verification (ACTIVE) |

| 55 | INC-20A | Declaration for commencement of business |

| 56 | AOC-5 | Notice of address at which books of account are maintained |

| 57 | DIR-11 | Notice of resignation of a director to the Registrar |

| 58 | GNL-3 | Particulars of person(s) or key managerial personnel charged or specified for the purpose of sub-clause (iii) or (iv) of clause 60 of section 2 |

| 59 | INC-20 | Intimation to Registrar of revocation/surrender of license issued under section 8 |

| 60 | INC-28 | Notice of order of the Court or Tribunal or any other competent authority |

| 61 | MGT-6 | Return to the Registrar in respect of declaration under section 89 received by the company |

| 62 | MGT-10 | Changes in shareholding position of promoters and top ten shareholders |

| 63 | MGT-14 | Filing of Resolutions and agreements to the Registrar under section 117 |

| 64 | MGT-15 | Form for filing Report on Annual General Meeting |

| 65 | Form 27 LLP | Form for registration of particulars by Foreign Limited Liability Partnership (FLLP |

| 66 | FORM 3 | Information with regard to limited liability partnership agreement and changes, if any, made therein |

| 67 | FORM 8 | Statement of Account & Solvency |

| 68 | FORM 15 | Notice for change of place of registered office |

| 69 | FORM 11 | Annual Return of Limited Liability Partnership (LLP) |

| 70 | FORM 4 | Notice of appointment, cessation, change in name/ address/designation of a designated partner or partner and consent to become a partner/designated partner |

| 71 | FORM 5 | Notice for change of name |

| 72 | FORM 12 | Form for intimating other address for service of documents |

| 73 | FORM 22 | Notice of intimation of Order of Court/ Tribunal/CLB/ Central Government to the Registrar |

| 74 | FORM 31 | Application for compounding of an offence under the Act |

| 75 | FORM 23 | Application for direction to Limited Liability Partnership (LLP) to change its name to the Registrar |

| 76 | Form 29 LLP | Notice of (A) alteration in the certificate of incorporation or registration; (B) alteration in names and addresses of any of the persons authorised to accept service on behalf of a foreign limited liability partnership (FLLP) (C) alteration in the principal place of business in India of FLLP (D) cessation to have a place of business in India |