NATIONAL COMPANY LAW TRIBUNAL

NEW DELHI BENCH

NEW DELHI

C.P.NO. 16/119/16

CA. NO.

PRESENT: SMT. INA MALHOTRA

Hon’ble Members (J)

NATIONAL COMPANY LAW TRIBUNAL

NATIONAL COMPANY LAW TRIBUNAL

NEW DELHI BENCH

NEW DELHI

C.P.NO. 16/119/16

CA. NO.

PRESENT: SMT. INA MALHOTRA

Hon’ble Members (J)

ATTENDANCE-CUM-ORDER SHEET OF THE HEARING OF NEW DELHI BENCH OF THE NATIONAL COMPANY LAW TRIBUNAL ON 7.10.2016

NAME OF THE COMPANY: M/s MVM Metal and Alloys Pvt. Ltd.

SECTION OF THE COMPANIES ACT: 621A

ORDER

The petitioner company, which was incorporated on 29.05.2007, has filed the present compounding application having been charged with the offence under section 220 of the Companies Act, 1956. Though the company filed its annual report for the financial year 2011-12 along with Board’s report dated 01.09.2012 during its scrutiny it was observed that the financial accounts for the year ending 2011-12 were not legible and hence not accepted.

2. It is submitted by the petitioner that the alleged non compliance was totally unintentional and without any malafide intention, on account of bad quality of scanning. On being put to notice, physical copies were submitted in the office of the RoC.

3. The offence is punishable u/s 162 of the Comapanies Act, 1956 which provides for an imposition of fine whcih may extend to Rs. 500/- for each day’s default.

4. Accordingly, the office of the Roc has calculated and recommended the imposition of the maximum fine of Rs. 5,83,500/– on the petitioner company and its three directors till resubmission of the documents in hard copy on 03.12.2013.

5. As per the report, prosecution has not been initiated.

6. Given the facts of the case as there is no legal impediment in compounding, the offence and the fact that the said default appears to be unintentional, it would be sufficient to impose a fine of Rs. 50,000/- on each of the petitioners, i.e. the company and its below mentioned three directors. Accordingly, the fine is imposed as under for the entire period of default.

Name of the Applicant Penalty

M/s. M V M Mettal & Alloys Pvt. Ltd. Rs. 50,000/-

Mr. Vijay Singla, Director Rs. 50,000/-

Mr. Ajay Budhiraja, Director Rs. 50,000/-

Ms. Pooja Gupta, Director Rs. 50,000/-

Total Rs. 2 Lacs

7. Subject to the remittance of the aforesaid fine within 30 days, the offence shall stand compounded. Compliance Report be placed on record with due intimation to the office of the RoC.

8. Petition stands disposed off in terms of the above and consigned to Record Room.

SHs may also please note that the form has been deployed as a purely confidence-building measure to assess the readiness of the companies to deal with COVID-19 Threat in India. As such no penalty or enforcement-related action is applicable. Stakeholders may at their convenience file this form. It is purely voluntary as part of our contribution towards joining the movement to fight against the spread of the disease. Since the portal may experience heavy load, it would indicate ‘Busy’ alert whenever peak traffic is reached.

SHs may also please note that the form has been deployed as a purely confidence-building measure to assess the readiness of the companies to deal with COVID-19 Threat in India. As such no penalty or enforcement-related action is applicable. Stakeholders may at their convenience file this form. It is purely voluntary as part of our contribution towards joining the movement to fight against the spread of the disease. Since the portal may experience heavy load, it would indicate ‘Busy’ alert whenever peak traffic is reached.

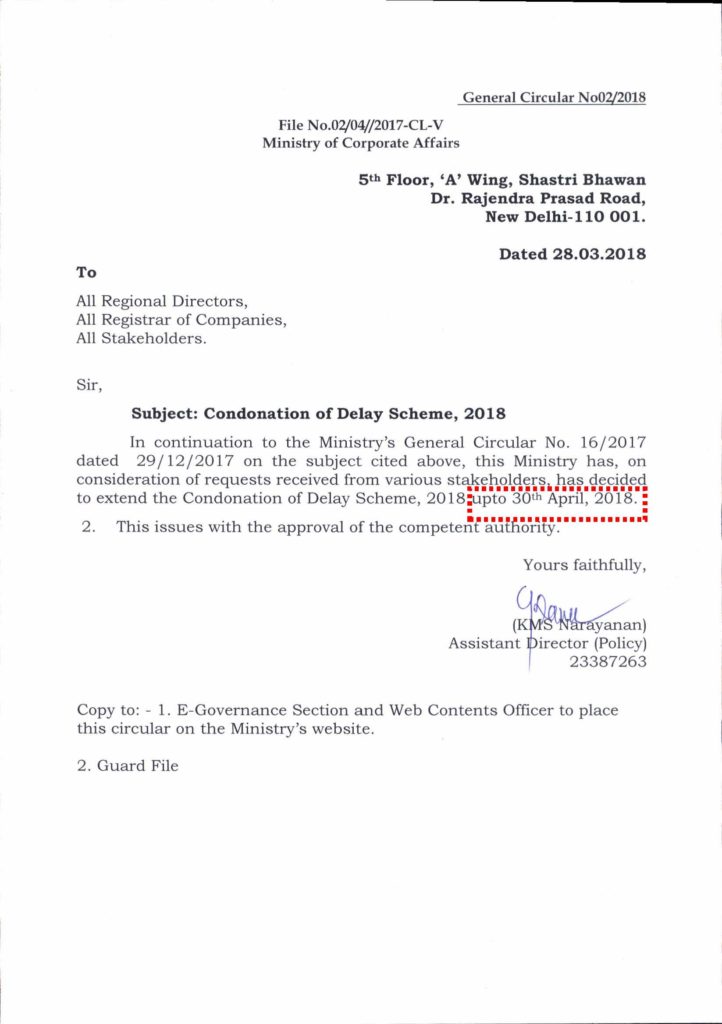

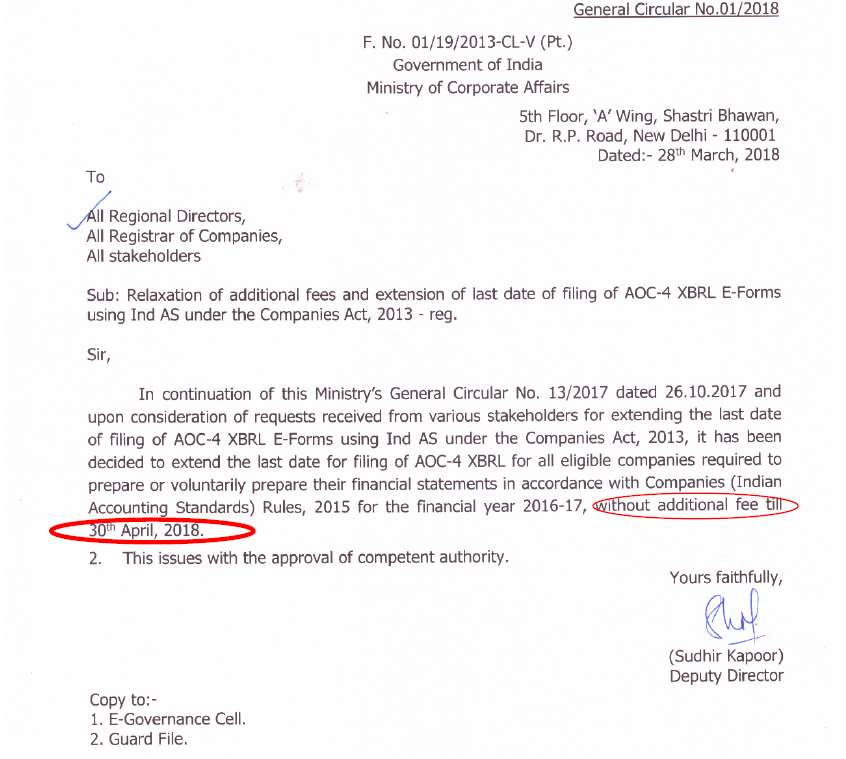

MCA notifies GOD FATHER DAY 01-07-2018 Additional fee of Rs.100 per day for delay in filing ROC Forms Annual Return/ Financial Statements (Forms 23AC, 23ACA, 23AC XBRL, 23ACA XBRL, MGT-7, AOC-4, AOC-4 XBRL and AOC-4 CFS)

MCA notifies GOD FATHER DAY 01-07-2018 Additional fee of Rs.100 per day for delay in filing ROC Forms Annual Return/ Financial Statements (Forms 23AC, 23ACA, 23AC XBRL, 23ACA XBRL, MGT-7, AOC-4, AOC-4 XBRL and AOC-4 CFS)

NATIONAL COMPANY LAW TRIBUNAL

NATIONAL COMPANY LAW TRIBUNAL